2021 started off hopeful. A push by the new administration to get vaccines into arms seemed to be off and running with people vying for appointments with limited amounts of vaccine available. As more vaccines came into production and more shots in arms, it seemed we were going to find a way to emerge out of the COVID-19 shadow, albeit with structural changes in ways of living, working and interacting.

As restrictions began to lift, Americans began to go out and demonstrate pandemic-driven, new-normal behaviors in socializing, eating out, making plans for in-person back-to-school, and leisure and business travel. As spring morphed to summer, sporting events made a comeback and local sporting venues and stadiums were returning to increased capacity. There was also a renewed optimism in travel, tourism and hospitality.

For most of 2020, Consumer Packaged Goods (CPG) and Distribution companies had to shift priorities during the pandemic as consumption moved from restaurants, stadiums and such to in-home. Food, beverage, hospitality goods, and especially alcoholic beverages that might have been packaged in larger pack-sizes for on-premise consumption in bars, restaurants, airports, and public places were having to shift to smaller sizes for in-home purchases. CPG companies massively reduced assortments to simplify sourcing, production and distribution. Retailers wanted this to amplify fulfillment velocity and precision. Now, with people getting out more, these companies were having to shift back to producing these larger sizes and planning to buy, stock, move, and fulfill the on-premise locations to keep up with surging demand.

However, as we move closer to the end of the year, the number of people getting vaccinated has slowed and a new variant has emerged – more infectious than the original strain. The industry had to once again learn to flex, become agile and drive business decisions to channel demand, supply and product’s flow path in near real-time.

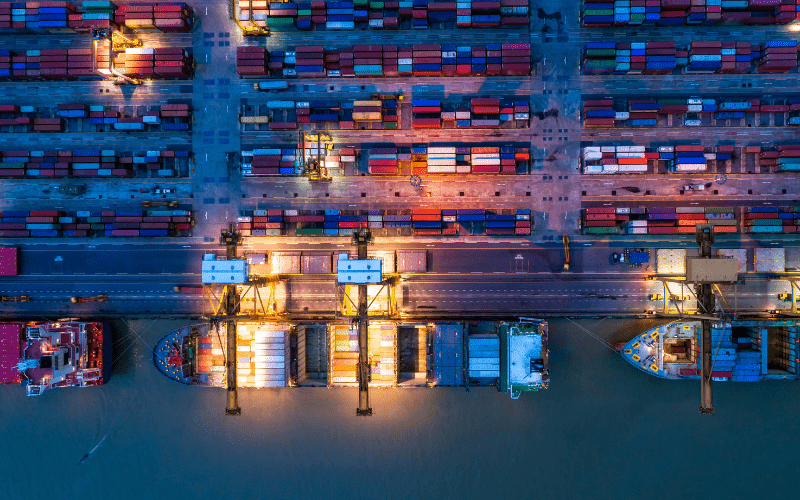

If that wasn’t tough enough, other challenges this past summer have been the impact of continued shocks and disruptions on the global supply chain. This includes this spring’s Suez Canal situation that left ships needing to divert and leading to delays, the Port of Yantian closure that will slow the delivery of 90% of the world’s electronics, to employee shortages, and fires at chemical and semiconductor plants causing a shortage of chlorine tablets much-coveted during the summer months to keep swimming pools afloat and microchips needed to power automobiles, consumer electronics and just about everything in these times of digital ubiquity.

The pandemic accelerated some of the trends that were in motion and completely changed others.

The biggest lessons learned from the past 18 months have been that businesses were not prepared to effectively respond to disruptions. As Dr. Simchi-Levi from MIT says, the Time to Survive (TTS), i.e., for how long can supply meet demand during a disruption, was significantly exposed due to lack of visibility. Similarly, companies had not invested in supply chain benchmarking and true end -to-end assessment to be able to understand the Performance Impact and Time to Recover (TTR), i.e., what time it takes to get back to normal operations. Lack of visibility to internal operations, and dramatic opaqueness in the extended supplier ecosystem, led to near-total breakdown of intelligent decisions and orchestration. Supply chain performance went for a toss and costs sky rocketed. The consensus is that supply chain practices with over reliance on just-in-time flows, cost-focused strategic sourcing practices and limited risk modeling exposed big rocks.

Blue Yonder’s call to action and the top strategic imperatives for business leaders is to align business, financial and operational strategies across end-to-end value network.

- Start by creating a single business plan that considers customers and the various tiers of suppliers in total.

- Perform segmentation to curate clusters based on value proposition, manufacturing strategies, fulfillment choices, inventory policies down to customer, product and market intersections to carry forward stratification of demand and replenishment streams.

- Model the key use-cases that enable the delivery of service as measured by the customer, balancing revenue, margin, cost to serve, and free cash flow goals.

- Model digital twin to represent the physical reality, assets, flow paths, and operational constraints.

- Conduct a comprehensive network design and optimization exercise.

It was clear that businesses needed visibility into demand, orders, inventory, shipments, and suppliers, as well as the ability to create what-if scenarios and response playbooks. This need for building greater transparency in the value network and creating business models that allow flexible and agile operations became a priority. And, these priorities are driving imperatives to connect updated business strategy, financial plans and operations models. The value of becoming more data-driven and reducing latency while driving more precise responses is clear.

Without generalizing, it is true that businesses are more prepared due to the experience and aforementioned investments to weather stress and strain on their networks. For example, the tech industry has seen a resurgence in business investments to predict, simulate and design network, logistics and customer service models to build capabilities to operate successfully in an omni-commerce environment.

The key lesson is disruptions are constant in supply chain and through better planning, visibility, and collaboration businesses can be better prepared to deal with them. Want to be prepared for the next disruption? Check out the Blue Yonder AI in Supply Chains eBook.