In conjunction with this blog post, watch our on-demand webinar Finding Focus in the Fight Against Inflation.

The 1970s are known for a lot more than Star Wars and pet rocks. The era is also known for supply-side economic shocks, low growth and high inflation.

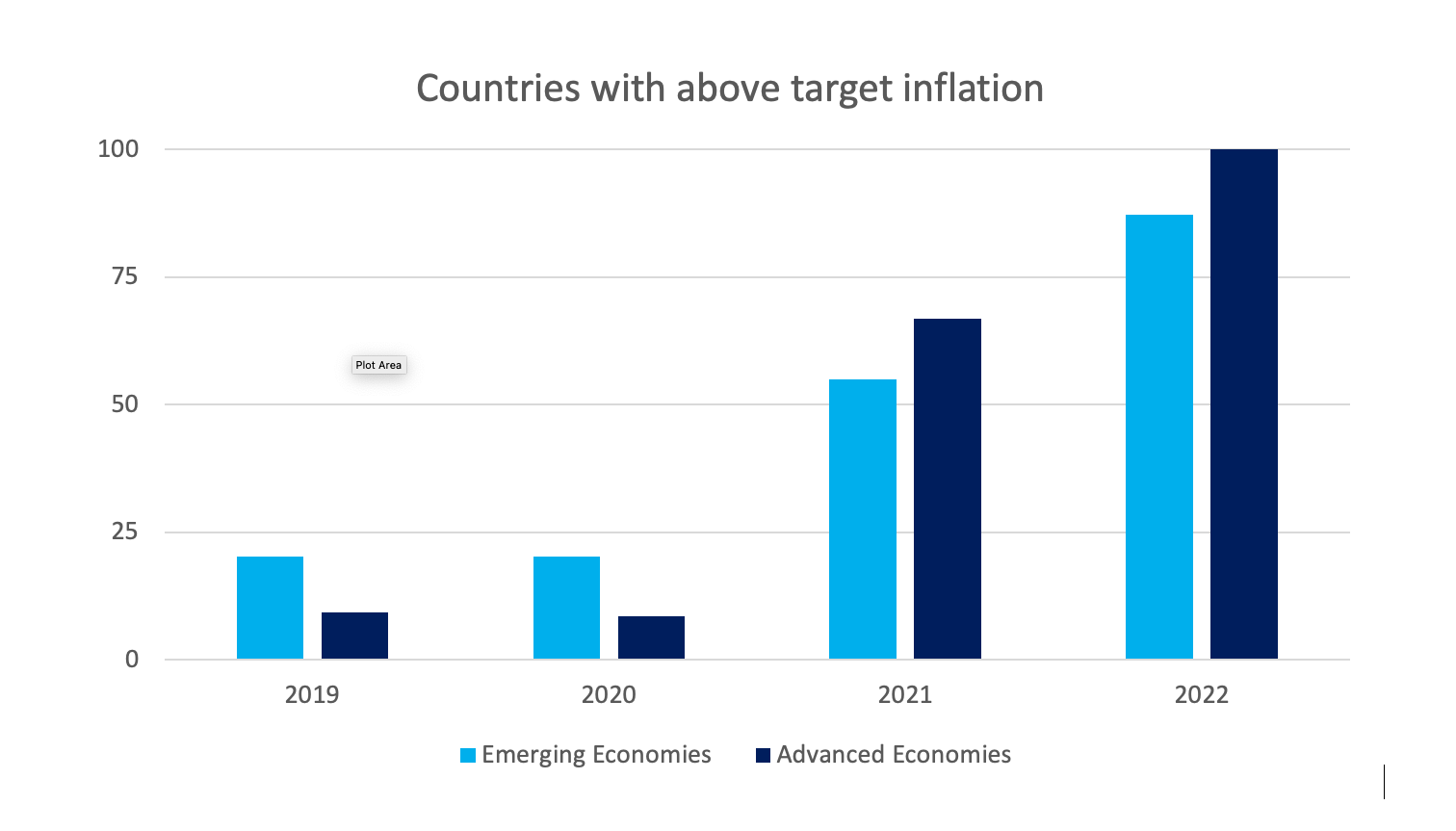

The parallels with today’s situation are uncanny. Prolonged supply chain disruption and high energy costs have pushed inflation in advanced economies to levels not seen for a generation. And while the rates of inflation around the world differ by country, the trend is clear: global inflation has returned.

https://blogs.worldbank.org/developmenttalk/global-economic-outlook-five-charts

Paul Volcker, chair of the U.S. Federal Reserve, led the fight against inflation in the 1970s by aggressively raising interest rates, peaking at nearly 20%. Unfortunately, two recessions followed that taught many lessons on better ways to manage inflation while avoiding deep recession. Much like then, retailers again face high inflation and rising interest rates. Higher input costs and higher prices are reducing consumer spending power, and customers are indicating change is coming:

- 83% of shoppers have noticed that prices are rising

- 95% of shoppers plan to change shopping behaviour if inflation continues

Customer spending is shifting to prioritize essentials (grocery, health and beauty, pet supplies) over discretionary categories (travel, entertainment, clothing), customers are showing a preference for value, private label sales are growing, and customers are more willing to try new brands or chains just like in the 1970s. Discounters, wholesale clubs, dollar stores, and private label are winning as customers chase lower prices.

And just like in the 1970s, Retailers are adjusting by:

- Shrinking their assortments

- Adding more private label lines

- Taking more frequent price changes

- Tightly managing margin and expenses

- Re-negotiating terms with suppliers

But the 1970s showed that balancing margin protection against higher prices – even when supported by suppliers – is rarely sustainable. The Home Depot, now the largest DIY chain in the world, opened its first store in 1978 in a space that used to be occupied by the Treasure Island discount chain, which shut down during the recessions of the early 1980s.

Retail expectations are also higher today and customers have grown used to omni-channel models. So, with all the lessons learned and information available today, why are we still acting like we did in the 1970s? Why are we still taking individual actions in isolation that ultimately get undone by other initiatives, even when seemingly aligned to the same outcome. It’s time to think differently and act tactically and strategically at the same time.

How to Act Tactically, Strategically

Today, supply chains need to be synchronized to solve big challenges. Thankfully, technology has made significant leaps since the 1970s, with cloud-based, unified platforms and AI-enabled tools allowing retailers to view and manage disruptions like inflation more holistically. Rather than taking isolated action via point solutions, they can act against strategic imperatives, proactively solving retail challenges aligned to value rather than tactically solving partial problems.

1. Delight your customers by ensuring that the right product is in the right place at the right time.

Category management used to be straightforward: keep retail shelves neat and as well-stocked as possible. But in today’s world of demand volatility, multiple selling channels, supply and labor shortages, and growing competition, it’s not that simple.

Managing categories requires localized assortments, space aware replenishment and the intelligence to automate in ways that minimize the workload on planners trying to understand the interplay between product substitutability, pricing and transferable demand in every store, every day.

Blue Yonder understands the complexities of modern category management and replenishment, where every change, no matter how small, can influence everything else, by synchronizing workflows across planning, merchandising and execution rather than silos.

2. Present a unified commerce experience to the customer, irrespective of the buying journey and channels navigated by the customer.

In a world where the in-store and online experience has blurred, many retailers are struggling to attract new customers, grow market share and serve e-commerce customers profitably, a problem made worse by the return of inflation.

Whether e-commerce continues to increase exponentially, or shoppers slowly return to physical stores, customers demand a seamless buying journey, starting with pricing that understands customer demand on the entire lifecycle, and spanning fulfilment pre- and post-order to ensure that every order is quickly and cost-effectively shipped from every location.

3. Boost profitability by aligning resources to customer demand and automating tasks where possible to help manage costs and expenses while improving the customer experience.

The return of inflation hasn’t yet sparked the high unemployment of the 1970s. Instead, labor shortages are making many of the labor-intensive tasks in retail more difficult to manage without a huge management overhead. Better aligning employees’ skills and shift preferences to anticipated need is a smarter way of lowering overall labor costs and helps keep employees engaged.

Pet rocks were a short-lived fad, but 1970s inflation lasted well into the 1980s. While it is difficult to predict how long today’s inflation will last, laying the foundations of a more resilient retail supply chain makes good business sense. Especially when it delivers short term relief that pays for itself.

If you would like help delighting customers, unifying commerce or boosting profitability, Blue Yonder’s Industry Strategy leads are available to help you. Reach your goals. Reach out today.

For more relevant content about inflation, watch our on-demand webinar Finding Focus in the Fight Against Inflation.