As we settle into the new decade, we look back on all the transformative activity within the retail industry over the course of 2019 and look forward to how it will shape the rest of 2020.

The ongoing trade war with China, holiday and consumer shopping trends, the increasing importance of social media for driving sales and the impacts of e-commerce on returns and sustainability have all made a splash in retail that will ripple into 2020.

While we continue to work with global retailers and supply chains to provide solutions to these developing trends and challenges, we wanted to further our understanding from the consumer’s point of view. That’s why JDA recently surveyed more than 1,000 consumers to understand their perceptions and preferences around the biggest trends in retail.

The survey revealed the following five trends to look out for heading into the new year:

Growing trade war concerns

Many consumers’ holiday shopping budgets were impacted by a potential rise in retail prices as a result of Chinese tariffs. JDA asked the same question in a survey from September 2019, and 46% of respondents stated that they plan to spend significantly to slightly less this year on holiday shopping. Concerns about the trade war with China have only grown since then, with 55% of respondents saying they planned to spend significantly to slightly less this year on holiday shopping (a 20% increase in three months)!

Increased focus on returns

When it comes to returning items or packages, paying to return packages by mail, requiring a receipt and narrow returns windows are the biggest inconveniences to consumers. With online shopping on the rise, returns will continue to be an important part of the customer journey and those who make the process as easy as possible for the consumer will thrive.

Artificial intelligence (AI) can be used to help retailers minimize returns with “returns-conscious” pricing, where items aren’t priced solely on what would be the most profitable, but on what price most effectively decreases their likelihood of being returned, decreasing the overall costs associated with returned items.

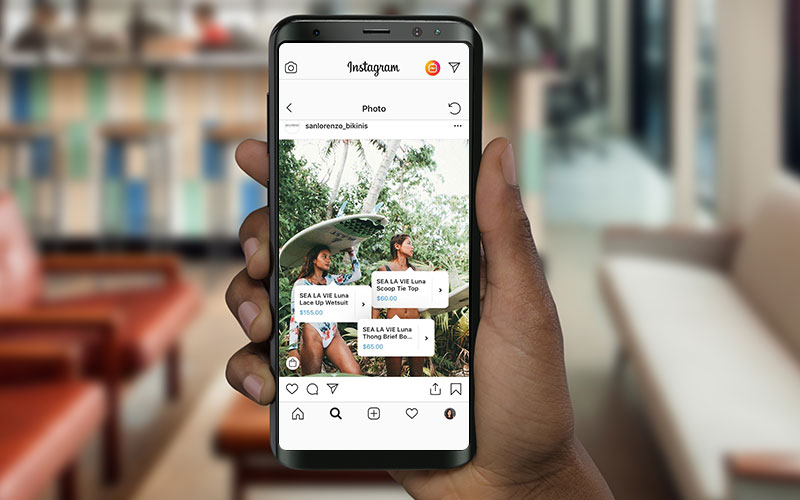

Social media advertisements driving sales

Most consumers primarily receive advertisements from their favorite brands on social media (36%), followed closely by email (35%). More than half of those respondents who primarily receive advertisements from brands on social media have made a purchase from a brand after seeing an advertisement on social media.

Sustainable shipping options

More than half of respondents consider the environmental impact of their chosen delivery method when making purchases online. Thirty-nine percent sometimes consider the impact and adjust to eco-friendly options, while 12% always consider the environmental impact and select more eco-friendly options.

Nearly a third of respondents (31%) claim to already have eco-friendly shipping habits, grouping deliveries whenever possible. After informing participants about the impacts of delivery on the environment, an additional 30% are now planning to group their orders more often to reduce their carbon footprint. Twenty-seven percent of respondents do not plan to make any changes to their delivery habits after learning about the impact of delivery on the environment.

Holiday shopping staples stand their ground

Even with the continued emergence of new promotional shopping days, mainly driven by the booming e-commerce sector, traditional deal days like Black Friday still lead the way for retailers.

When shopping for family and friends this holiday season, participants are most likely to buy clothing (25%), followed closely by gift cards (24%), the latest electronics (22%), educational gifts (16%), experiences (12%) and subscription-based gifts (less than 1%). Most younger respondents, ages 18-29 (31%) and 30-44 (26%), are primarily looking to buy clothing for family and friends, while the majority of older respondents, ages 45-60 (29%) and 60+ (37%), are looking to buy gift cards.

After analyzing the results from our survey, it was not surprising to see these notable trends fall under a group of categories we refer to as SNEW – social, news, events and weather. Retailers need to be able to do more than just react to these external factors if they hope to remain competitive in today’s fast-paced environment and meet growing consumer demands.

Integrating AI and ML throughout supply chains can help retailers adapt in real-time. Whether it’s a breaking development in the ongoing trade war, a timely viral video, or consumer data on returns, sustainable fulfillment and holiday shopping, AI and ML solutions draw actionable insights for companies to create efficiencies while streamlining operations.

Solutions operating under JDA’s Luminate Control Tower, like Luminate Store Fulfillment and Luminate Demand Edge, leverage the capabilities of AI and ML, allowing retailers to take real-time actions like pulling trending topics from social feeds to integrate them into planning processes. The end-to-end supply chain visibility unlocked by Luminate Control Tower can help retailers optimize their returns, pricing and inventory management processes by putting the right items, at the right prices, in front of the waves of customers returning products after the holidays, all while enhancing sustainability efforts and reducing waste across their supply chains. This visibility and collaboration not only enhance overall in-store experiences while building loyalty and driving profits, but it helps retailers better align with shifting consumer preferences while minimizing environmental footprints.