Digital Supply Chain Trends in High Tech and Semiconductor, Part 1

In a series of blog articles, the Product/Solutions Marketing team explores new business challenges and innovation solutions to change the game and manage disruptions. The following are the insights gained from my discussion with Puneet Saxena, who leads Blue Yonder’s High Tech and Semiconductor Industry Strategy, during a recent Blue Yonder Live and executive customer events that we prepared for jointly.

Demand and Supply Dichotomies

Terence: High tech and semiconductor companies are managing many changing market dynamics. Puneet, you have three decades of experience in this industry and have led consulting, solution strategy, and industry strategy for Blue Yonder. What are the key high tech and semiconductor industry trends you are seeing in the market and that are part of our customers’ boardroom discussions?

Puneet: High tech and semiconductor companies have taken a step back to evaluate global macroeconomic circumstances, including inflation, business slowdown, concerns about the recession, rising interest rates, and the Ukraine conflict. There is a very interesting dynamic at the moment, with a dichotomy on both the demand side and supply side.

On the demand side, we have been reading about semiconductor shortages for the duration of the COVID-19 pandemic. Now we are seeing a slowdown in the demand for memory chips, which has resulted in prices dropping. Part of it is the slowdown in demand for laptops, smart devices and smartphones, which were in higher demand at the start of the pandemic when everyone went to work/school from home.

But on the other hand, demand for data center products, cloud computing technologies, and high-performance computing is going through the roof. If you are on the demand side of the organization and managing a portfolio, you are trying to predict how deep the slowdown would be for parts of the portfolio while for other parts you are seeing that the demand is very strong.

Terence: That makes it difficult to manage the supply chain and profitability. Please also educate us on the current supply side picture.

Puneet: On the supply side, there is a similar dichotomy. Automotive companies are seeing the chip shortage as easing. But there are some companies in the semiconductor industry enjoying very high demand. For TSMC, one of the largest foundries, half of their revenues comes from five nanometer and seven nanometer chips. This is the most modern of the silicon nodes and the supply side on these nodes is still constrained.

With these demand and supply side dichotomies, companies in the high tech and semiconductor industry are navigating through foggy weather, which is getting thicker by the day.

Fighting the Battle Against Multiple Adversaries

Terence: Let us drill down on what the companies are doing about these challenges. What are the key supply chain business needs today? And, going forward, what are these companies doing to counter disruptions and make themselves more profitable?

Puneet: From my three decades of experience in this industry and from my early managers, we have two enemies or adversaries as supply chain professionals – and we are fighting constant battles against them. The first one is the obvious one: inefficiencies. There is value trapped in inefficient process and we have been using the Theory of Constraints to help.

The second enemy is uncertainty. If the demand were not volatile and the supply were not volatile, our lives would be much, much simpler. But that is not the case, especially now.

Over the years, I have discovered that there is a third enemy: latency of information. I will explain more later.

To answer your question, supply chain processes and systems are needing new capabilities to fundamentally battle these three adversaries: inefficiency, uncertainty, and latency. I really like what Infineon, one of our customers, say and practice: If you try and predict the future, it is likely that you won’t be very good at it. You will always be wrong. But what you can do is be prepared for the future and for different circumstances. This is my first takeaway for the audience in terms of new supply chain capabilities that they need.

New Enablers For These Battles

Terence: Can we really do that and with good outcomes? What are the key supply chain capabilities required to address today’s business challenges?

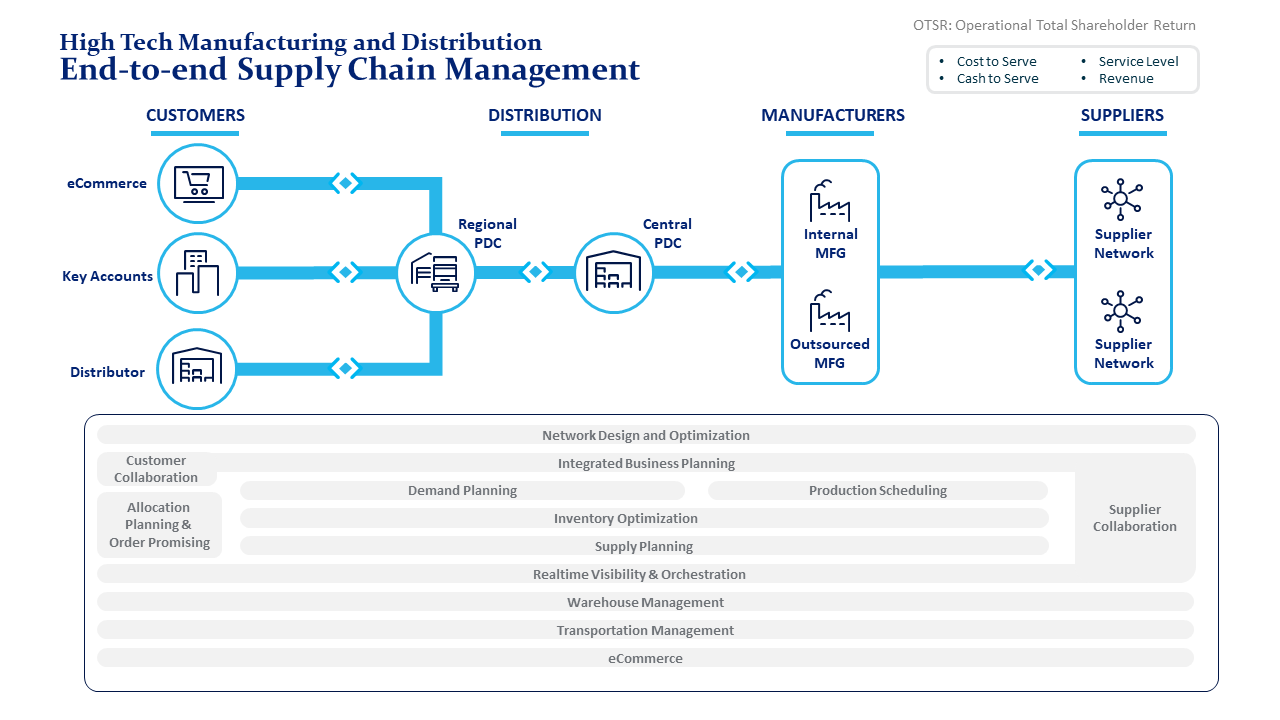

Puneet: Let us discuss with the help of the diagram below, which contains a simple representation of the supply chain from suppliers to manufacturers, the distribution channels, and all the way to the customers. Underneath the diagram are the processes. For example, network design and optimization is a business process. Where should our factories be? Where should our distribution centers (DCs) be? Which lanes, which transportation mode should we be using? New capabilities for this process can drive resiliency, speed and competitiveness.

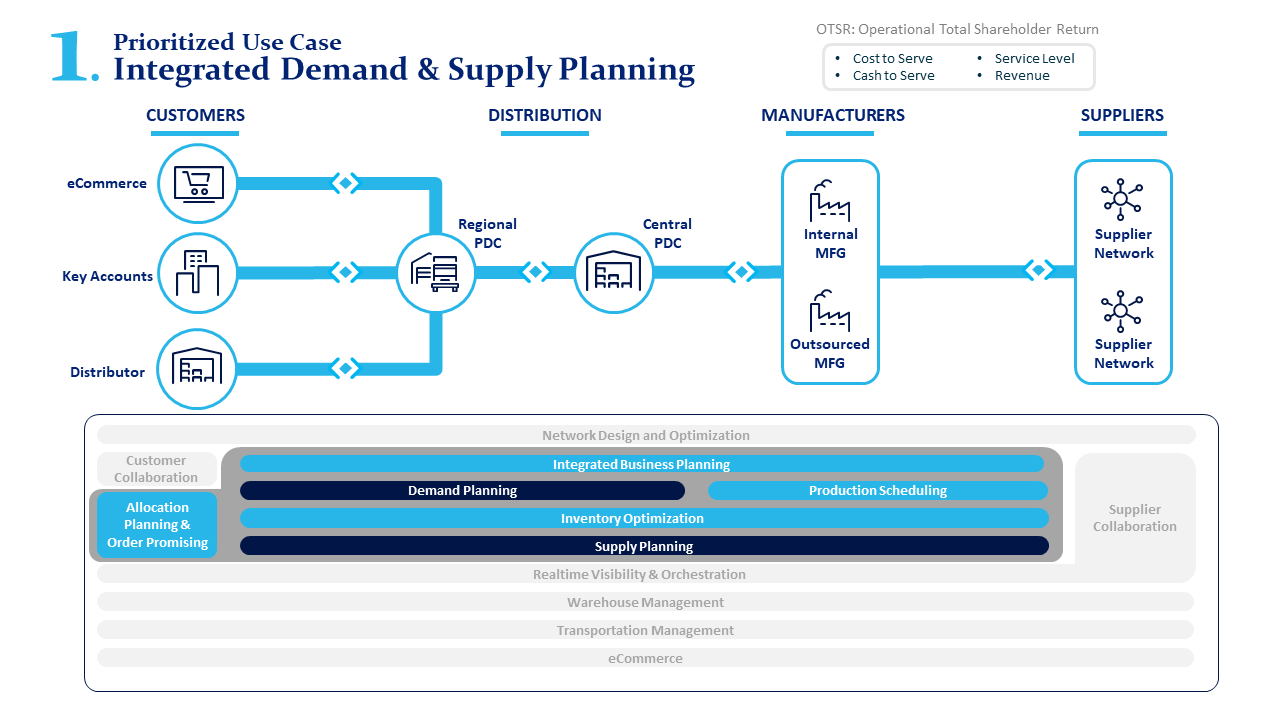

Of the three priority use cases where I am working with our customers, the item that is top of mind is integrated demand and supply planning. Referring to the second diagram below, the processes highlighted in gray are demand and supply planning. They are the essential building blocks to predict demand and position supply. There are smarter ways to think about demand planning and supply planning. If we cannot predict the future perfectly, can we be prepared? Can we think through scenarios? Can we be ready with playbooks? This is where the world is for some of the innovative thinkers that we are working with.

For example, Micron Technology, our customers, is leading in the area of integrated demand and supply planning. They have spoken in public forums about the remarkable work building supply chain resiliency.

And we are now offering integrated demand and supply planning in our Manufacturing Industry Cloud for High Tech for quick deployment and time-to-value with flexible scope of applications and pre-configured:

- Industry specific, role-based workflows

- Industry practices templates

- Advanced analytics

- Extensive connectivity

More Insights to Come

In an upcoming Part 2 article, we will get more insights from Puneet about other priority use cases and how the industry is leveraging artificial intelligence (AI) and machine learning (ML).

In the meantime, please review our white paper “The Semiconductor Industry Imperative for Supply Chain Resiliency.”