Transportation Modeling and its Role in Transportation Transformation, Part 1

In their journey toward transforming their existing transportation and broader supply chain operations, many customers face challenges in substantiating their business case when it comes to crucial pillars such as better capacity allocation, asset optimization, and redefining procurement services. Utilizing a modeling solution to complete network analysis can assist in identifying solutions to these critical challenges.

We recently had two supply chain and technology veterans discuss how Ernst & Young LLP (EY) leverages Blue Yonder’s Transportation Modeling capabilities to identify solutions and quantified the business case for customers’ digital transportation journeys:

- Vivek Chhaochharia, Managing Director, Digital Supply Chain Leader at Ernst & Young LLP

- James Peck, Vice President of Presales for supply chain execution at Blue Yonder

To watch the session, check out LinkedIn. Below is a recap of the conversation:

The Role of Digital Simulation in Transportation Transformation

Terence: Vivek, you and your team have recently developed a whitepaper «Transportation Transformation Visualized through Digital Simulation.» Can you share the role of digital simulation in transportation transformation? Why there is a need for such service?

Vivek: For many clients, EY Teams focus a lot on strategy development. What should our clients be doing three months, six months, one year, and three years down the line? And when we help clients define their strategy and roadmap, the focus is always on:

- How do we improve customer service?

- How do we drive improved savings out of my transportation spend, etc.?

Now, whenever we do this strategy work, a lot of times the key ask from a planning perspective isn’t does all this makes sense, but what’s the business case for the value behind it? How do we justify the investment? Can we say we are going to drive $500M, $1 million, or $2 million in savings? When we quantify the expected amount, that becomes easier to align and get approvals from leadership. Having that strong business case becomes very important.

Historically, we’ve always had multiple tools to do such business cases, ranging from spreadsheets to various off-the-market tools. Now, we are really standardizing on the Blue Yonder transportation modeling solution as go-to platform for such kinds of studies. We believe having a scientific way to come up with a business case is very important. And especially in today’s competitive world, the key is having a very strong, well-defined business case that we can stand behind and achievable numbers that clients feel very comfortable with. This is where a modeling tool like transportation modeler becomes very important, especially in today’s world given what we have seen across the industries as a result of the COVID-19 pandemic.

The industries are seeing carriers going out of operations, as well as huge capacity shortages, both in terms of driver capacity and ocean capacity. All of these factors have a big impact around your transportation. And companies are struggling to figure out alternative modes and options to handle their requirements. Again, what better way to do this than modeling.

Another good example is we are seeing supply chain distribution networks changing. Two years ago, companies were shipping products directly to restaurants. Today, those products may be shipped to the grocery stores instead as a result of lower consumption at restaurant from the pandemic.

A lot of shifts are happening from a supply chain perspective. And almost every company is getting impacted by this. EY Teams are helping clients leverage this tool to figure out what their future networks look like. Based on that, what is the right strategy to adopt to drive higher savings.

What is Modeling?

Terence: James, please describe Blue Yonder’s transportation modeling solution.

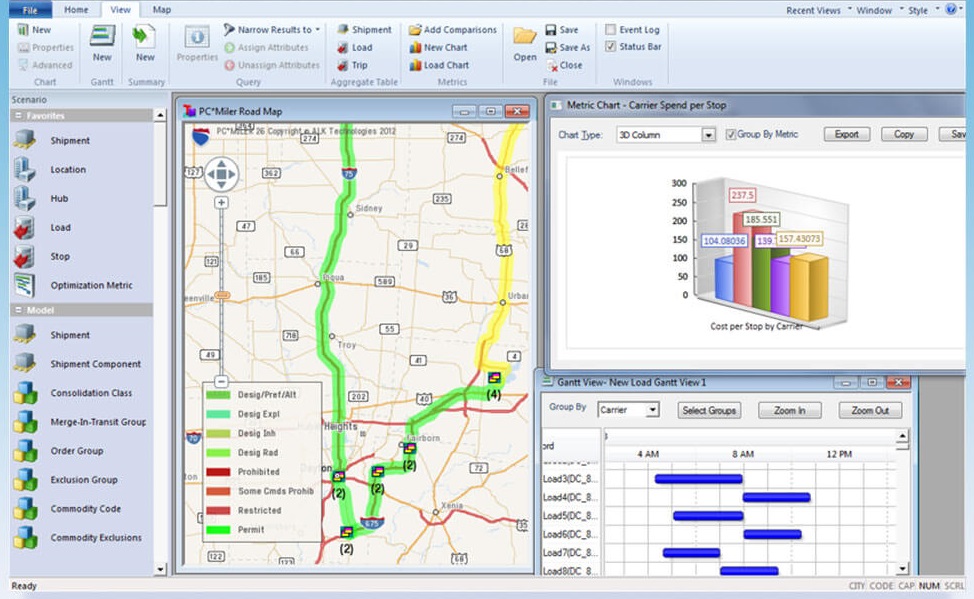

James: If you ask all the industry analysts and Blue Yonder’s customers what we are really good at, they will say that we excel at planning, optimizing, and managing all the business rules and the complexity of their supply chain. Transportation modeling is using our LuminateTM Platform, which is powered by AI and ML. We have an entire customer base that drives savings across their companies using this solution.

The focus can be on:

- Optimizing inbound from vendor to distribution centers

- Making things more dynamic versus a static network

- Proving that cross-docking is an opportunity

- Combining the outbound and the inbound world, potentially resulting in savings (they may currently have anoutbound side with fleet assets that are very separated from inbound)

This solution is widely used in the shipper marketplace by many industries. We also have a large 3PL customer base. The users can be from:

- an existing customer leveraging this tool by linking right into the Transportation Management System (TMS) to do what-if analysis, linked into your rating database and your business rules and constraints.

- a company that is using another TMS, or using spreadsheets. The company can leverage this tool in the cloud, essentially using this tool as a standalone.

The customer can bring data in from Excel spreadsheets or Access databases. And the output is typically Excel or Access as well. You can essentially model what you did last week down to the penny, and then start to look at what-if scenarios. And so that’s an ongoing process for many of our customers.

Key Areas and Benefits of the Study

Terence: Vivek, can you describe what areas would the EY studies include? What are the key benefits of doing such an EY study?

Vivek: There are a few areas:

- The first one is around fleet strategy. EY Teams help figure out when does it make sense to have a dedicated or a private fleet operation in the first place. If yes, what should the size of the fleet be? Where should our fleet assets be positioned across multiple network? We would help quantify: does it make sense to have 12 or 100 tractors and trailers? What is the exact number and what is cost versus benefit analysis? It is very critical to have a tool like this.

- The second area is broader strategies like outsourcing. Many companies are trying to figure out whether it makes sense to outsource transportation or keep it insourced. If I have it insourced, does it make sense to invest in a TMS or to manage my transportation with spreadsheets? I’m able to quantify for customers if you were to outsource, the amount of savings you will be looking at versus if you were to insource and invest in a TMS.

- The last area is for multimodal strategy, whether it makes sense to introduce new modes and new equipment types. For example, there’s a lot of new emerging technology from electric trucks to new kinds of equipment. Is there a real ROI in getting green and investing in new equipment? What’s the savings drivers behind those?

In Part 2, Vivek and James will discuss how modeling and other areas of technology will enable the digital journey.

The views reflected in this article are the views of the author and do not necessarily reflect the views of the global EY organization or its member firms.