Grocery/Holiday Consumer Survey: 4 Trends to Keep Your Eyes on for the Remainder of 2020

With another change of season and 2021 fast approaching, 2020 presses on as a year that has redefined what it means to adapt. As the world continues to address the evolving challenges presented by the COVID-19 pandemic, here at Blue Yonder, we’re closely monitoring the changing commerce environment to predict what lies ahead not only for consumers, but the retailers and manufacturers working to keep up with their increasing demands and shifting preferences.

Building on our March, April, and 2018 holiday surveys, Blue Yonder surveyed more than 1,000 U.S. consumers between Aug. 20-21, 2020, to stay abreast of any notable shifts in consumer perceptions and shopping habits, particularly related to grocery as year end and holiday celebrations approach. The results point to the pandemic’s overwhelming impact on consumers’ increased migration to online shopping, deviation from traditional grocery shopping habits, and the evolution of grocery delivery.

People are doing more online shopping than ever:

- 82% of consumers indicate they are doing either SLIGHTLY or A LOT more shopping online because of the pandemic. This number was 74% in April and 57% in March

Despite the nation’s economic downturn and the end of the federal stimulus that had largely driven consumer spending, retail sales reported its fourth straight month of growth in August, however modest. As consumers continue to avoid physical contact by social distancing and pantry loading leaves aisles barren, it is no shock that we’re seeing people pushed to online platforms to satisfy their shopping needs.

Retailers have shown resilience by providing customers with access to nimble e-commerce alternatives, but how can they ensure these new habits stick? Modern commerce strategies require customer-centric supply chains powered by technology that delivers real-time visibility and actionable insights to source, promise and fulfill orders while being able to deliver a differentiated experience to end consumers from the start of the shopping journey.

Consumers are grocery shopping less often, but spending more per trip:

- 40% of consumers are grocery shopping less often than normal, compared to 25% who are shopping more often

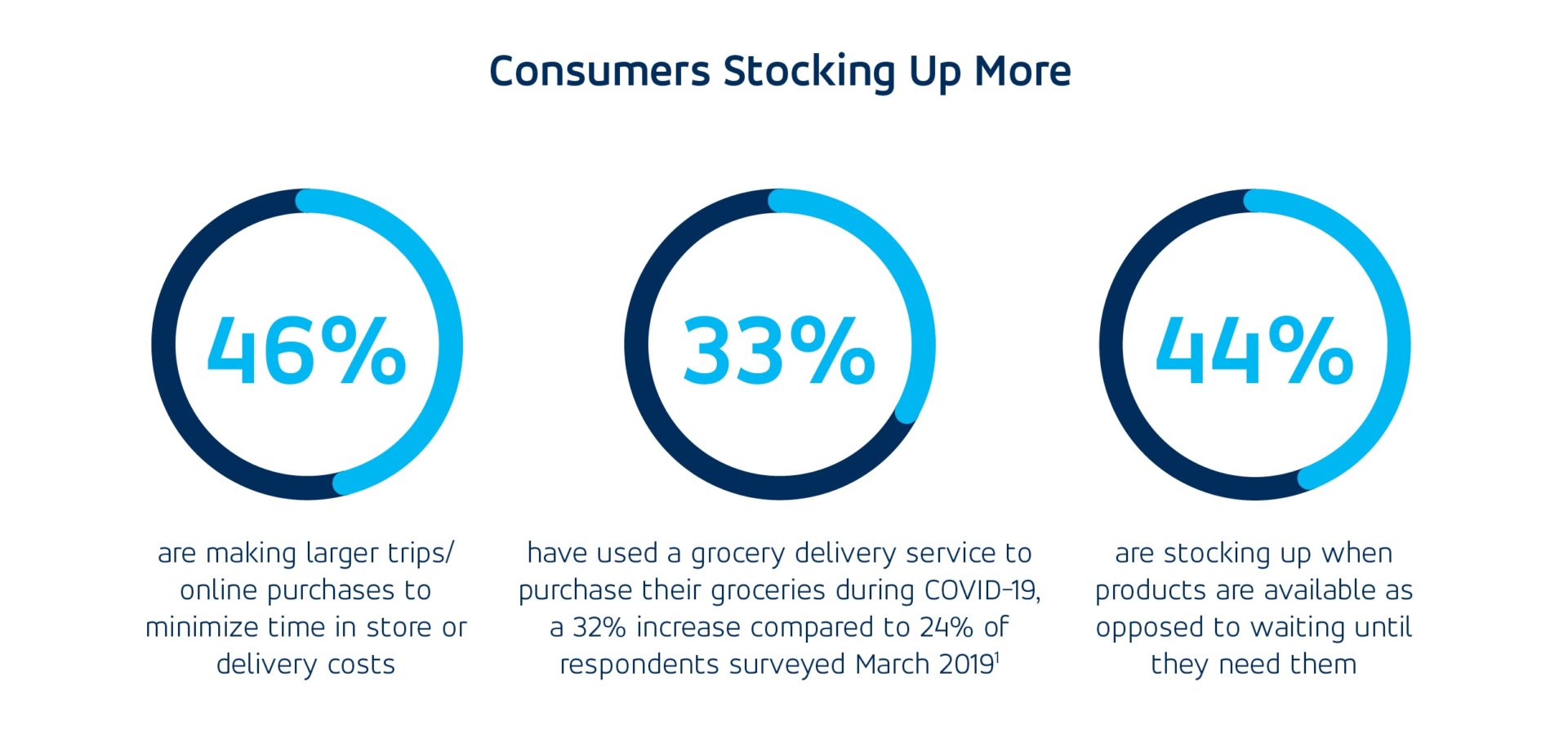

- 46% are making larger trips/online purchases to minimize time in store or delivery costs

- 44% are stocking up when products are available as opposed to waiting until they need them

In-line with consumers moving to online shopping and e-commerce channels, many may be grocery shopping less frequently than usual to avoid contact and interaction as the pandemic persists. This is leading to bigger shopping carts, calling for reimagined forecasting and replenishment strategies to ensure inventory levels can support these bulkier, less consistent trips to the store and online purchases.

On top of less frequent shopping trips, reemerging out-of-stocks of products like paper towels are driving consumers to buy in bulk, spending even more per trip in anticipation of future shortages. Together these trends are making customer satisfaction an even higher priority than usual for retailers – with customers making fewer overall trips, a single negative experience can easily cause a customer to try your competitor. And if they are satisfied there, they are less likely to return.

Traditional business processes don’t offer visibility into these continually shifting demands and legacy systems are unable to meet the needs of these changing times. The result is out-of-stocks, lost sales, excess inventory, and unnecessary waste. Grocery retailers require advanced solutions with real-time visibility, artificial intelligence (AI), and machine learning (ML) baked in, enabling them to improve operations and meet growing customer needs with accurate forecasting, store replenishment, price optimization, and warehouse management.

Grocery delivery continues to work out supply chain kinks

- 56% of respondents have experienced grocery delivery delays compared to 54% in April

- 18% have experienced delays of 3+ days, a 36% decrease compared to 28% in April

- Only 7% have been unable to secure a delivery window compared to 17% in April, a decrease of more than 40%

As consumers increasingly flock to grocery delivery services, it’s reassuring to see that the length of delivery delays and the inability to secure a delivery window is decreasing. This is in line with what we’re hearing from grocery retailers about how they are better handling their e-commerce operations and making more achievable commitments in terms of fulfillment and workforce as they adjust to volatile market swings throughout the pandemic.

Like all e-commerce adoption, whether grocery delivery will persist in a post-pandemic world will depend on grocery retailers’ ability to get customers the right products at the right time while combatting the additional costs and razor-thin margins associated with e-commerce. Strategically positioning inventory in hyperlocal micro-fulfillment centers will allow retailers to reduce last-mile delivery costs while housing personalized inventory tailored to where shoppers live.

The number of people hosting a holiday gathering is dropping (and fewer are shopping in-store):

- 52% of respondents plan to host and grocery shop for a holiday celebration this season. This is a 32% drop from the 76% of respondents who grocery shopped for a holiday celebration in 2018

- 68% of consumers that will grocery shop for the holidays this year plan to do so in-store. This is an 18% drop from 83% of respondents surveyed in 2018

- Of those planning to host and grocery shop for a holiday celebration, nearly 40% are preparing for small gatherings with only 3-5 guests, 44% are preparing for medium-sized gatherings with 6-10 guests, and nearly 20% are preparing for large gatherings with 10+ guests.

The upcoming holiday season will present uncertainty for consumers and retailers alike, calling for a reimagined approach like many other aspects of 2020. Restrictions on social gatherings will inevitably impact the size of holiday gatherings between family and friends, making it difficult for grocery retailers to prepare for the usual demand for items typically associated with the season.

With a lessened need for massive in-store shopping trips to support large gatherings, more conservative grocery orders will likely move to online delivery channels. Holiday grocery delivery orders come with increased customer sensitivity, requiring a heightened customer-first mentality to ensure positive outcomes. It’s imperative that grocery retailers plan with the online customer in mind and can successfully do so by implementing intelligent supply chain tools to connect data and processes together to strategically and profitably react to changes in consumer behavior.