You wouldn’t know it from what you see today, but the first Jack-o’-lanterns were made from turnips. In fact, the event that we now call Halloween was based on the Celtic festival of Samhain, marking the end of summer. Villages celebrated with harvest feasts, and the bones of sacrificed animals were thrown on bonfires to help ward off bad spirits as the darkness of winter closed in.

Today, British children dress in costume and carve pumpkins in what many regard as an imported American event.

Clearly, events change over time.

The British may have been slow to adopt the American custom of carving pumpkins, but customer habits are changing quickly. Halloween spending on pumpkins has grown by nearly $7m in the last three years.

While the US enjoyed holiday sales 8.3% higher than 2019, British retail managed a mere 0.3% Christmas increase. Same event, but an entirely different effect in each market. Nor was the effect evenly felt within Britain — while holiday clothing sales rose by 21.5%, food sales fell by 3.4%.

Understanding how an event shapes demand is critical to producing a good demand forecast, which in turn directly influences inventory levels, resource schedules and assortment planning. Accurately understanding how event-led demand increases for some products around events, then tapers, can have a dramatic impact on the bottom line.

When we think about events, we tend to focus on the big ones like Halloween or Christmas. We might consider the uplifts in demand, such as the 28,000 kilos of strawberries consumed each year at Wimbledon. We rarely have the capacity to consider in detail events such as school holidays or religious observances, even though these can have a material impact on granular demand.

Blue Yonder has always understood that events are one of the key inputs in predicting volatile customer demand. Our AI-driven forecasting engine uses events as one of the main drivers for accurate, fast and flexible automated demand forecasting built around an innate understanding of the complex and inter-connected network of influencing factors, such as price and weather.

Unlike data for price or weather, events have traditionally been left to the discretion and judgement of people. Understanding the context of an event, how wide and long its impact is at the local level, has not been possible without the use of machine learning, even with large teams of analysts.

When McKinsey surveyed 170 CFOs, they found that 40% wanted to improve their forecasting, with many looking to big data to improve fine-grained accuracy, introduce flexibility and accelerate results.

PredictHQ, one of Blue Yonder’s newest partners, has built a business around the science of events. They track roughly 20 million events annually across 19 different categories, in 30,000 cities globally, which removes the need to stitch data together through multiple APIs or maintain an in-house team to manually collect events.

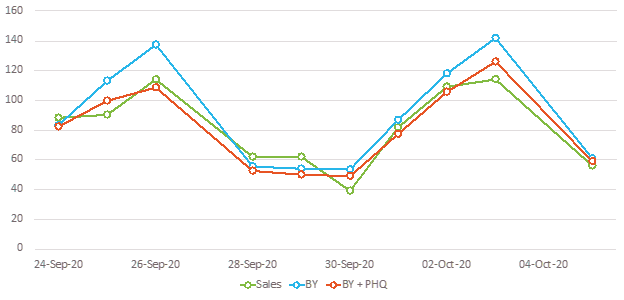

We can see the improvement of Blue Yonder’s automated AI forecast with a PredictHQ’s intelligent event service for a Northern European grocer. Running the same forecast with the inclusion of regional school holidays as opposed to the forecast without the same data demonstrates the potential for improvement in two individual locations.

The shape of demand curve, and match to the actual sales, is much closer than the feed that ignores the regional school holidays. And with the new partnership between PredictHQ and Blue Yonder, accessing intelligent, structured data that can improve the forecast is now as straightforward as including location specific weather.

Predicting the shape of demand for next year’s Halloween pumpkins just got a lot easier.